Trading of distribution grid flexibility in different time horizons

- How can Distribution System Operators (DSOs) procure local flexibility services through market-based instruments?

- Could the Transmission and Distribution System Operators cooperate and combine the wholesale and retail electricity markets?

- What is the role of Flexibility Aggregators in the market and how could they participate and benefit?

These are the questions FEVER innovative market mechanisms try to answer.

The answers were not easy and involved a lot of research both in terms of finding the best market design and in overcoming modelling challenges and solutions complexity. We exchanged ideas with colleagues around the word, attending 4 scientific conferences in Europe and worldwide, we studied a lot, 2 team members presented their PhDs and 1 is yet to come, we coded a lot, and we finally made it. The market mechanisms are ready, validated in networks of different sizes and ready to simulate real grids from FEVER pilot data!

Let’s get to know them!

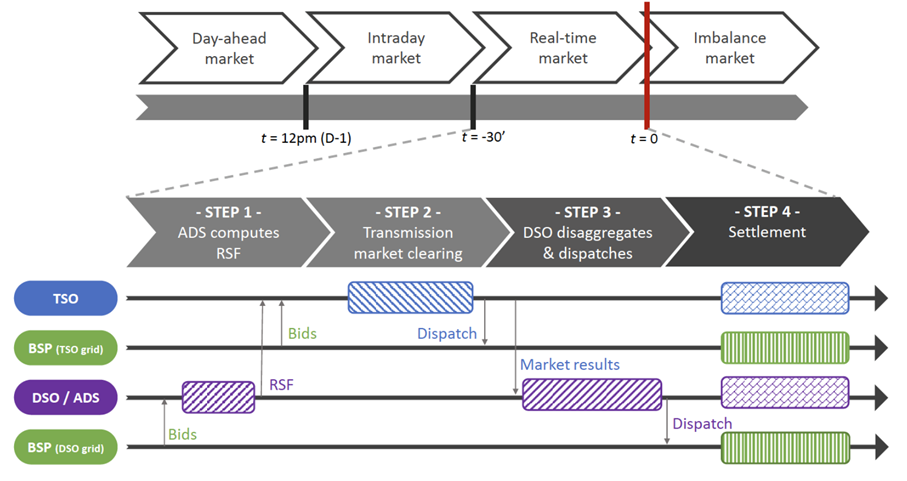

From day-ahead to real-time operations, the proposed mechanisms are: a day-ahead two-level iterative market mechanism, a continuous trading mechanism for grid energy and a real-time mechanism for congestion management and balancing purposes.

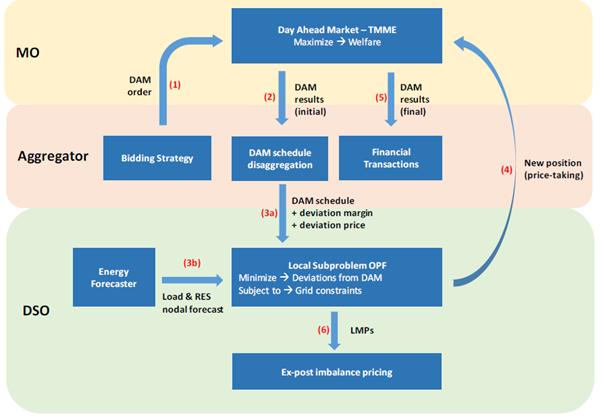

For the day-ahead allocation of flexibility, a day-ahead optimization problem, considering both the central market mechanisms and the decentralized local distribution grid is modelled. In the latter, the several technical constraints and grid issues can be identified and resolved. But this was not easy! The challenges were many and required the application of tailored methodologies and thus extensive literature review and research work to be resolved. The first step was finding representative networks that incorporate the distinct characteristics of distribution networks. Then, HEnEx studied approximations of the alternating current power flow for representing distribution network constraints, as well as methodologies for incorporating distribution grid constraints in market clearing. And we made it! The integrated model is ready for assets of the distribution grid to provide their flexibility without causing problems to the network.

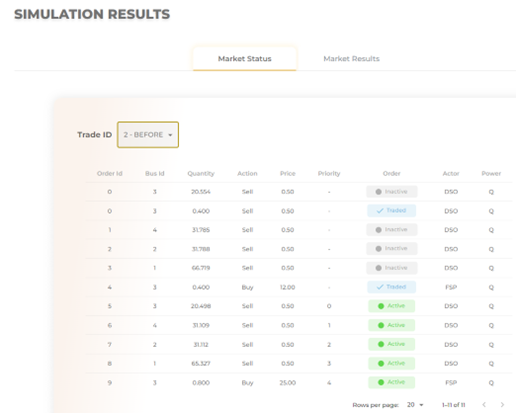

To further enhance the secure operation of the distribution grid in case of unpredictable events, the DSO and aggregators can trade grid energy and services in FEVER continuous market to resolve emerging issues. Based on up-to-date information, the grid operators determine where and when congestion can be expected. To solve this congestion, the grid operators submit flexibility requests and notify the owners of distribution grids assets to offer flexibility. But do the trades respect the network feasibility checks? Can sensitive network data be shared with the market? Is the transmission system affected by the trades? Our mechanism addresses all the above challenges and enables trades through a user-friendly interface.

In order to connect the energy markets with the (future) real-time electricity balancing markets such as MARI, FEVER proposes a real-time multi-layer iterative mechanism to provide ancillary services to the electricity balancing market. While the balancing platform foreseen in Europe relies on a zonal model of the grid and therefore does not model the intra-zonal constraints, the objective of the hierarchical mechanism is to implicitly model the intra-zonal network constraints through the merit order that is transferred to the balancing market platform. The platform accounts for the complexity of the physics of the networks and non-convex bid structures, and is able to return a dispatch solution as well as prices. An important feature that such a framework should incorporate is decentralized decision-making, something that motivated us in selecting the hierarchical structure of the framework.